Joe Pawlak & Melissa Wilson

By all accounts, the restaurant industry is roaring back to life as vaccination distribution spreads, dine-in restrictions are lifted and improved weather throughout most of the country sends consumers flocking to restaurants to dine with friends and family. Operators are reporting same-store sales approaching, and in some cases exceeding, pre-pandemic levels as pent-up demand drives the dine-in surge and off-premise orders remain strong.

For restaurant operators eager to return to full capacity, however, significant headwinds remain as the restaurant industry struggles to fill jobs to meet this booming demand. The biggest challenge facing operators in this current recovery period is finding staff willing to work. There are numerous other factors that are impacting employment in the restaurant industry; these effects will be felt not only during the immediate post-pandemic recovery, but well into the future. Given the broader societal shifts emerging as a result of the pandemic, differing generational viewpoints toward traditional business workplace models, as well as looming demographic changes, it’s important to begin thinking about the longer-term implications for the restaurant industry and how industry norms and cost structures will be reshaped in the future.

The goal of this whitepaper is to evaluate those potential changes and help foodservice operators, distributors, suppliers and others serving the industry to begin developing strategies around the longer-term ramifications of the labor crisis in the restaurant industry. As always, Technomic will continue to update our thinking on the outlook for this industry as the situation evolves.

Restaurant Employment Situation

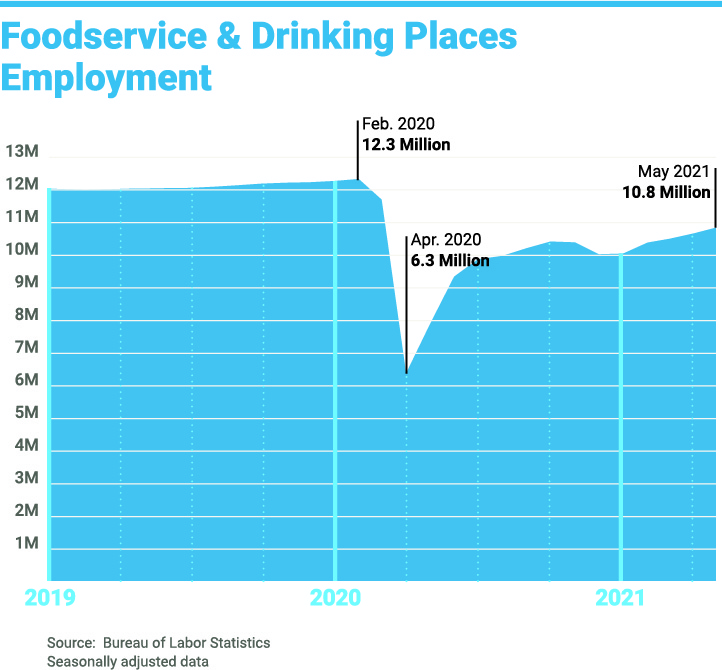

Restaurants currently employ 10.8 million workers, a massive rebound from last April when the industry shed almost half of its workforce. Yet the industry remains about 1.5 million workers short of its pre-pandemic employment base.

Job openings in the hotel and restaurant sectors have risen dramatically since vaccine distribution expanded beginning in January. By March and April 2021, job openings in these sectors had reached their highest level ever recorded. These spikes were quickly eclipsed in May, when more than 1.3 million openings were reported, representing a 35% increase vs. April and an even more astonishing increase of 48% vs. May 2019, well before the pandemic.

The restaurant industry is not alone in its struggle to fill job openings. Total job vacancies in the United States increased to 9.3 million in April from 8.3 million in March of 2021, highlighting the fierce competition from other industries for available workers.

Workers in the foodservice and accommodations sector quit their jobs at record levels in April. The quit rate, which refers to the percentage of people who voluntarily leave their jobs over the period, reached 5.6% in April, an all-time high for the industry and more than double the overall total rate across industries.

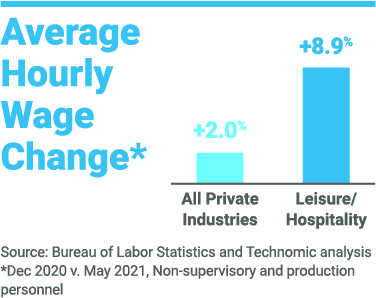

The cost of labor is skyrocketing within the restaurant sector, increasing 12% in April 2021 versus April of last year.

The increase in leisure/hospitality wages (a large portion captured by restaurants) is more than four times that of all industries.

Despite employing a variety of approaches—from increasing starting pay and offering sign-on and referral bonuses to hosting job fairs and offering incentives to potential workers who complete an on-site application—90% of restaurant employers in a survey conducted by Restaurant Business (May 15, 2021) report that hiring is more difficult than it was before the pandemic. What are underlying reasons for this?

Short-term Employment Challenges

Federal Unemployment Subsidies

In the same Restaurant Business survey, the overwhelming majority (79%) of operators point to federal subsidies on state unemployment payments enacted during the pandemic as the primary cause of their recruiting challenges. The consensus is that potential hires are sitting on the sidelines as COVID relief aid is a comparable income substitute. Many stories are making the rounds regarding operators receiving countless number of employment applications, but very few applicants are appearing for interviews (as simply submitting a job application is a requirement for receiving unemployment benefits).

Restaurateurs are not alone in viewing federal unemployment subsidies as a hindrance to hiring. So far, twenty-five states have withdrawn several months early from federal unemployment programs that are scheduled to run through September 5 in an effort to spur greater participation in the workforce.

Child/Family Care

Parents with children have a pressing need for affordable and reliable child care to be able to return to work; at the same time, childcare programs are facing their own challenges as the economy reopens. The Massachusetts Business Coalition for Early Childhood Education reports that one out of five childcare centers have not reopened since the pandemic hit. Moreover, childcare programs are also contending with their own unprecedented staffing shortages, leading to fewer spots and long waiting lists. This situation is exacerbated by concerns that children have not yet been approved for vaccination. Similar labor shortages remain for in-home caregivers for elderly or disabled family members, resulting in family members filling that role and leaving them unable to commit to work away from home.

Health Concerns and Vaccination Status

As of June 21, 65% of the adult population has received at least one vaccine dose and 56% are fully vaccinated. While this is laudable progress, a relatively large portion of the population has not yet been vaccinated, leaving workers with health concerns or vulnerable family members at home feeling uncomfortable returning to the workplace until higher levels of vaccination are attained. Further, according to a recent poll conducted by CNN, more than a quarter of American adults say they do not intend to get the vaccine. For an industry in which many restaurateurs are requiring their staff to be vaccinated, this further reduces the eligible labor pool. Additionally, some potential employees are reluctant to join an industry which has significant interaction with the public, post-pandemic.

Lower Teen Participation in the Labor Force

Although teenagers have traditionally been viewed as a key option for boosting staffing in restaurants during the summer months, the reality is that teen labor force participation has been declining for several decades. There has been a recent boost to teen employment rates, with the promise of higher wages and job flexibility. However, this spike has only made a small dent in abating the overall labor problem, and it is expected to be short-lived as the summer wanes and teens return to school.

“Rusty” or Inexperienced Workforce

The long duration of dine-in closures and capacity restrictions in many areas means that returning employees are “rusty” and will require retraining, while new hires requiring full training may represent a substantial percentage of staff. Addressing ongoing recruiting and training needs amid the current surge adds additional stress and work demands for both unit-level managers and current staff members and could accelerate the already high quit rate in the industry.

Long-term Challenges

Beyond these near-term issues, other longer-term labor challenges are expected to face the restaurant industry in the years ahead.

Wages and Working Conditions

Over the past fifteen months, many people across a wide array of industries have taken the time to reevaluate their working life and job/career choices and as a result, many former restaurant industry workers are choosing not to return to their former employers—or to the industry. With everyone in the industry—and in many others—looking to hire, the competition is more intense than ever. Although wage competition is indeed fierce, the traditional compensation models and demanding working conditions of the restaurant industry have also become obstacles to workforce restoration. Surprisingly, only 13% of restaurant operators in the Restaurant Business survey believed that they are losing employees to other industries; however, Technomic believes this impact is more substantial.

Fully half of restaurant workers were abruptly thrust into unemployment in March 2020 due to policy mandates that shuttered restaurants. In the past, these employees could readily find employment at another restaurant, but this option evaporated during government-mandated shutdowns for dine-in occasions. While full-service restaurants swiftly pivoted to offering takeout and curbside pickup, this shift placed a spotlight on the industry’s heavy reliance on tips to provide income for front-of-house workers, as consumers are less accustomed to tipping for takeout orders.

With no safety net available, many restaurant workers were forced to seek other employment. Some swiftly switched to self-employment, offering a wide array of services from pressure cleaning to lawncare to personal shopper/chef, etc. Others signed on with third-party grocery and food delivery services, which had already been luring restaurant workers before the pandemic with the promise of flexible hours. As warehouse/distribution centers, last-mile delivery retailers and other industries such as construction with soaring demand added hundreds of thousands of jobs with pay starting at or well above the $15 minimum wage long-sought by restaurant workers, many former restaurant employees grasped these opportunities to restore their income.

The challenges for the restaurant industry are two-fold: 1) Many former employees subsequently found that they enjoyed no longer having to rely on the largesse of consumers for their daily income, no longer having to work late at night or on weekends and finally receiving benefits such as health insurance, sick pay, tuition assistance and more that they were seldom offered in the restaurant industry; and 2) The higher wages and benefits offered by other industries for entry-level positions will continue to significantly impact unit-level economics for restaurants.

Workforce Demographics

An examination of the projected share of households (by age of head of household) reveals an issue not only likely to impact foodservice spending in the future, but also the available workforce. The share of households between the ages of 25 and 44 is projected to decline between 3 percent and 7 percent by the year 2025, highlighting the smaller available pool of potential employees for the restaurant industry. The U.S Bureau of Labor Statistics also projects the number of teens in the labor force, a traditional pool of candidates for the industry, will drop by 660,000 over the next 10 years. Moreover, as already mentioned, the percentage of teens participating in the workforce had already been declining since 1979 and this decline is expected to continue.

In addition, recent amendments to the U.S. immigration program have further reduced the number of available workers for restaurant jobs, although changes in policy could potentially increase immigration levels after the pandemic is over. Nevertheless, it’s clear that the industry may no longer be able to rely on the government’s HB-2 program to augment the workforce.

Industry Reputation

One of the greatest challenges to overcome in the aftermath of the pandemic is the industry’s long-standing reputation. Although chain restaurants and more forward-thinking operators have integrated more professional approaches to business operations over the past few decades, the industry has long been known for high turnover, transient workers and in some cases, unprofessional management practices. This reputation has been exacerbated in recent years by reality television shows that drive ratings by placing a spotlight on unsavory business practices and personnel in the restaurant and bar industry. Working conditions that include long hours, constantly changing schedules, few benefits and the frequent requirement of working late nights and weekends have all contributed to the industry’s reputation as a less-than-desirable employer. Due to the current staffing crisis, existing employees are now struggling to keep up while working longer hours in a highly stressful environment. This has been made even more challenging by high levels of demand and impatient customers.

The government-mandated shutdown at the onset of the pandemic highlighted significant differences in workplace culture, not only in comparison to other industries, but also in how differently operators treated their employees in this unprecedented situation. Some operators dug into cash reserves to continue paying staff at some level until PPP loans became available or set up food distribution centers to provide meals to furloughed employees, while others abruptly dismissed long-term staff and shuttered the business until reopening became an option. Not surprisingly, operators that provided as much support as possible to their teams and maintained communications are achieving better results in bringing their teams back to work and recruiting others.

Other Rising Costs Add to Adversity

Amid fierce competition across numerous industries for staff, the higher wages and benefits offered by other industries for entry-level positions will significantly impact unit-level economics for restaurants, now and in the years ahead. Other challenges discussed above may require fundamental restructuring of traditional compensation models and working conditions at the unit level to provide a better working environment and enable the restaurant industry to become more competitive with other industries/fields as an industry of choice.

All of this comes to bear at a time when multiple other cost pressures are escalating, including:

Off-premise costs—including commissions for third-party providers, increased packaging costs and other ancillary expenses related to off-premise fulfillment.

Rising commodity costs—the Producer Price Index for food (wholesale product cost) demonstrated the highest increases since 2008, driven by higher raw material costs, higher labor productions costs, product shortages and elevated demand from China. As a result, core commodities like chicken, pork, shortenings/oils and grains have increased in cost from 21% (chicken) to more than 100% (grains). In addition, crude oil is at its highest price in three years and gasoline prices are up 37% in 2021, increasing transportation costs for distribution.

Increased sanitation expenses—increased expenses in this category are expected to not only remain at a higher level than prior to the pandemic, but grow further due to increased dine-in business.

While commodity cost increases may recede as supply-chain disruptions are overcome and sanitation supply needs may decline over time, increased labor costs will remain significant issues for operators and suppliers in the years ahead.

What Does the Future Look Like?

The longer-term labor force challenges facing the restaurant industry will accelerate other industry trends that existed pre-pandemic, as well as expansion of new operating models driven by reinvention of the industry during the pandemic. The way that restaurants look and operate will be altered to accommodate a smaller workforce and the need to optimize both dine-in and off-premise experiences. Changes that we expect to see as the industry adapts in the years ahead include:

More automation in both front-of-house and back-of-house

More off-premise-only locations

Fewer dining rooms in the limited-service segment and reduced dining capacity in full-service restaurants

Evaluation and improvement of restaurant working conditions and retention efforts

Reinvention of traditional compensation models used by the restaurant industry and more effective promotion of career opportunities.

Recommended Actions

Technomic recommends that operators and suppliers take the following steps to offset the current challenges and position the industry for continued success.

Operators

Elevate retention to the top of the priority list and proactively engage with current team members to communicate all steps being taken to alleviate the situation.

Focus on cross-training staff to handle multiple duties and potentially increase job satisfaction.

Analyze your business flow to identify opportunities to reduce days of operation and trim business operating hours with minimal revenue impact.

Evaluate all areas in which technology and software solutions can accelerate staff recruiting and training, streamline current operations and reduce time spent on day-to-day operational tasks, from daily checklists to product preparation.

Streamline the menu to optimize SKUs and reduce complexity of production; evaluate options for leveraging value-added products.

Add or encourage reservations and increase promotion of opportunities for consumers to order-ahead to optimize business and production peaks.

Off-load off-premise production for both core brand menu and any virtual brands to off-site locations/ghost kitchens to reduce pressure on dine-in unit staff.

Identify opportunities for communication to improve external perceptions of career potential and brand reputation as an employer of choice.

Food/Beverage Suppliers

Focus discussions with operators on product options to assist in managing labor costs, including speed-scratch and value-added products.

Emphasize opportunities for cross utilization of SKUs to simplify operations and reduce waste.

Review product prep and training materials to simplify for new hires and provide more online training modules to support remote training.

Monitor developments in adoption of labor-saving equipment, robotics and new facility design to assess any adjustments required for your products or preparation instructions.

Identify opportunities to support operator communications for improving external perceptions of career potential in the industry.

Final Words: Technomic's Take

During the early stages of the pandemic, there were significant concerns that recessionary factors and a renewed appreciation for cooking at home could hinder resurgence of the industry. The high levels of off-premise usage throughout the lockdown periods demonstrated that consumers continue to rely heavily on foodservice as a primary source of meals. As virus cases continue to recede, Technomic’s predicted industry surge is in full force, driven by pent-up demand, interest in socializing and the key consumer drivers of convenience and experience that were in play before the pandemic.

This surge in demand, while extremely welcome and reassuring for the outlook of the industry, has been accompanied by a host of challenges on multiple fronts, most notably labor shortages and supply-chain issues (driven by labor shortages on the production side), which may curb the pace of recovery over the next few months. On the longer-term horizon, ongoing labor constraints and escalating labor and product costs create a compelling need to evaluate every opportunity to create greater efficiencies for reduction of costs. At the same time, the foodservice industry overall must prioritize development and implementation of strategies to improve its reputation and viability as a place for long-term employment.