ADVISORY BLOG—

A New Focus on Health in Foodservice

In response to rising prices, consumers are becoming more cautious with their spending. This is impacting foodservice, as consumers seek greater value to ensure the spend is “worth it.”

From Subject Matter Expert, Kathryn Fenner, Senior Principal

Exhibit 1

When it comes to defining value, though, it’s important to remember that price isn’t the only factor that consumers take into consideration. In fact, quality and taste rank higher and are more important to creating value than the price of an item. At the same time, consumers show a growing interest in health. It’s critical, therefore, that manufacturers and operators strike a balance between price and other measures (e.g., quality, taste, service, health, etc.) most important to their target customers. In this paper, we’ll discuss how the definition of health is changing and how better-for-you ingredients can have a role in providing value and quality to consumers in away-from-home spaces.

The Importance of Health

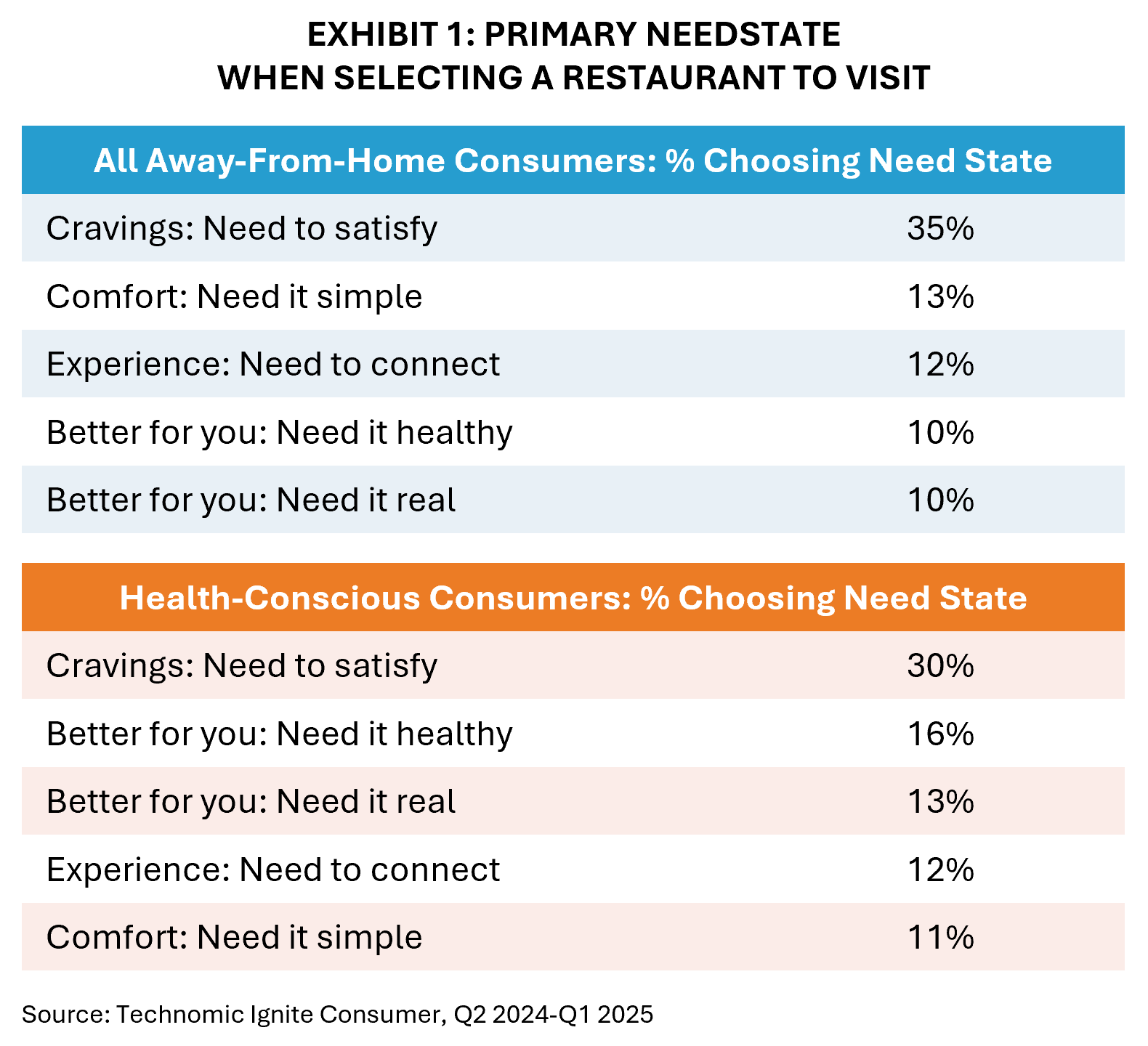

For 20% of today’s consumers, “better for you” is the primary need state when choosing a restaurant. That said, cravings are still the top need state overall, even for those away-from home consumers who identify as being health-conscious (See Exhibit 1). Still, while craveability remains the most common need state, more than half of consumers want restaurants to offer more healthy food options, an increase of 3 points compared to just six months ago (See Exhibit 2). This suggests that, when targeting occasions where patrons eat healthier, it is important to develop menu items that balance both craveability and better-for-you benefits.

Defining Health in Foodservice

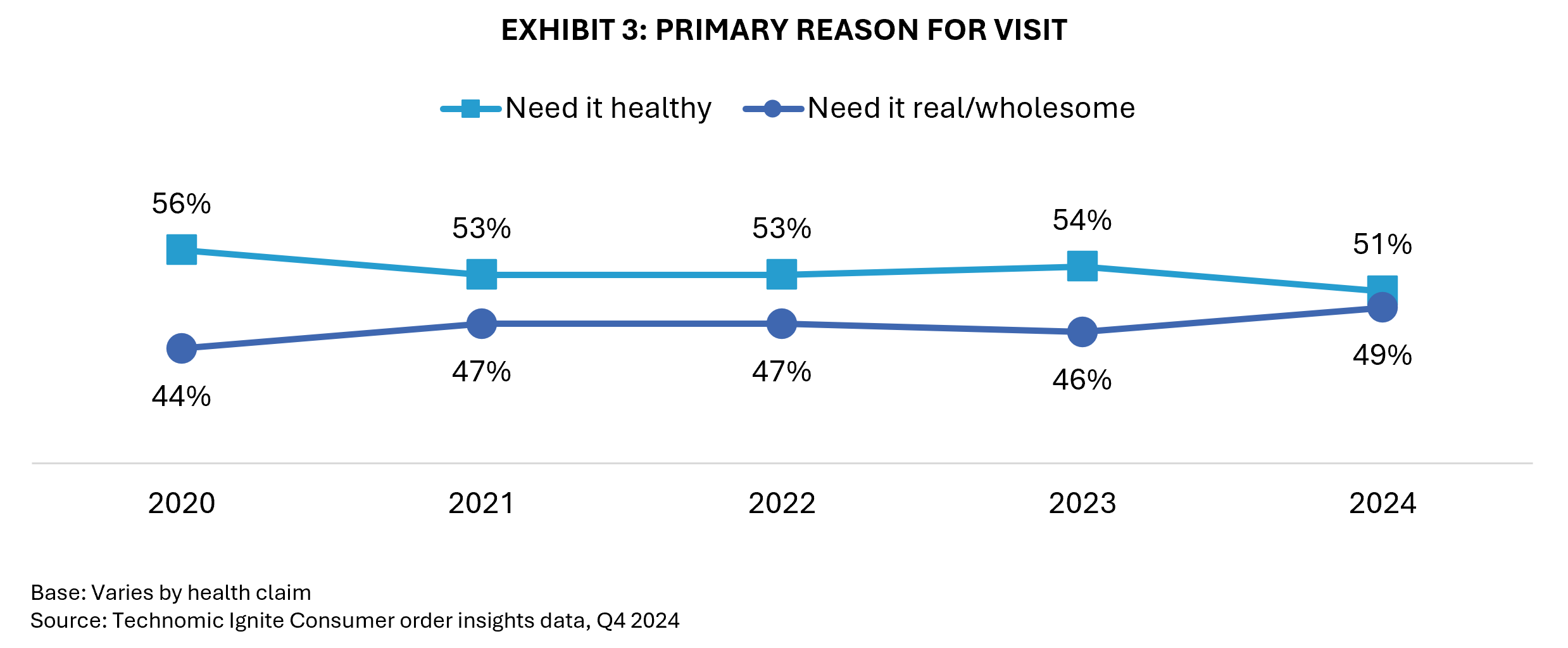

The meaning of health is becoming more individualized, making it difficult to settle on a single definition. Among consumers identifying a better-for-you need state for a recent occasion, however, we see the definition is shifting from saying they “need it healthy” and indicating growing interest in “need it real/wholesome” (See Exhibit 3). This shift is expected to continue, as real and wholesome foods are more likely to be perceived to offer positive health benefits without detracting from taste.

However, recent research from Technomic suggests that operators are not necessarily aligned with this new definition of health. Operators are focused on dietary restrictions (which can be important, such as in the case of allergens) but most are not focused on the transparency and sourcing claims that consumers want.

Impact of MAHA

Another potential reason for increasing scrutiny on healthy diets is the focus of the current U.S. government administration. In May 2025, the Make America Healthy Again (MAHA) Commission, led by the Department of Health and Human Services Secretary Robert F. Kennedy Jr. released a report focused primarily on chronic childhood diseases. The Make Our Children Healthy Again Assessment is critical of many elements of the current U.S. diet, including ultra-processed foods, artificial dyes and seed oils, among others.

Artificial Dyes: An Example

The U.S. government recently announced plans to phase out eight widely used artificial food dyes from the U.S. food system by 2026. This will likely alter the coloring of many commonly used candies, cereals, sports drinks, baked goods and more. At the time of this writing, the directive is a recommendation from the government, not a legal requirement, though that could change. While it remains optional for manufacturers, it’s important to understand the potential impact this announcement could have.

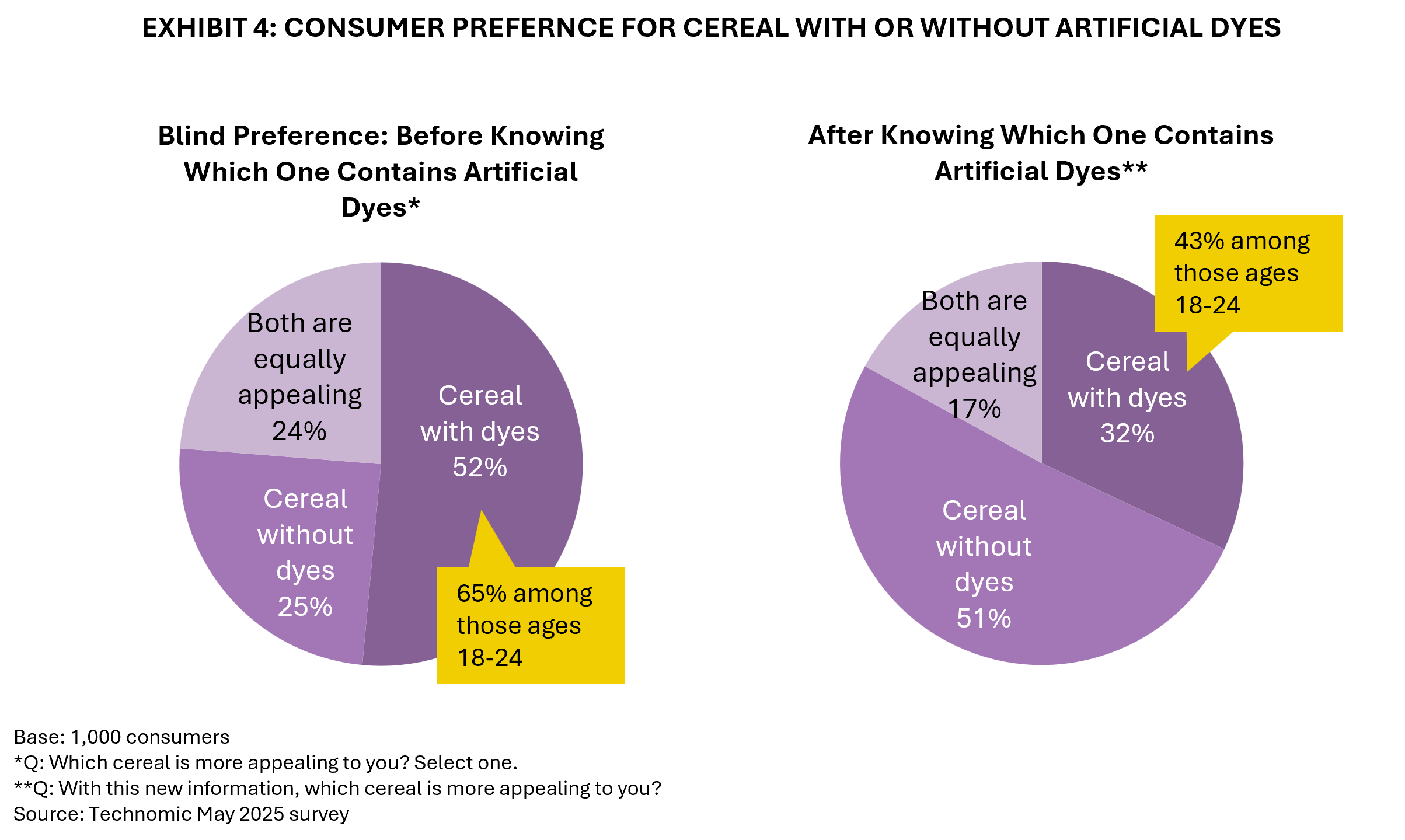

Technomic surveyed 1,000 consumers to understand their current preferences when it comes to artificial dyes, a focus of the MAHA agenda. In a blind A/B test, we showed consumers two images of cereal—one that contained artificial dyes and one that did not. Without sharing that only one of the bowls contained artificial dyes, we asked consumers to rate which bowl was more appealing to them, based on visual appearance alone. The cereal that contained dyes was preferred by 52% of consumers. We then revealed which bowl contained artificial dyes and again asked consumers to rate which was more appealing to them, given this new information. Preference for the cereal containing dyes dropped to 32%, and preference for the dye-free cereal climbed from 25% to 51% (See Exhibit 4). It is interesting to note, however, that four in 10 Gen Zers continue to prefer the cereal with the artificial dyes, even after having knowledge of the ingredients’ inclusion.

Next, when asked specifically about their personal opinion on the government banning artificial food/beverage dyes in grocery stores and restaurants, 68% of consumers had a positive reaction. Further, when asked what their response would be to learning a menu item contained artificial dyes, 23% said they would no longer order it and another 30% said they would order it less often.

Overall, consumer sentiment seems to be supportive of the movement to remove artificial dyes. This, then, may have more to do with why certain manufacturers have been proactive and announced plans to eliminate artificial dyes from their products versus doing so in response to the MAHA recommendations.

And for those who serve the education segment, it is interesting to note that the state of California, often on the leading edge of health trends, recently announced a ban on specific dyes in schools. This will force some companies to reformulate products to avoid loss of volume in California.

Now, reformulating products in this manner is no simple task for a manufacturer. It requires finding alternative ingredients, which may or may not be abundantly available, and may come at a greater cost. It also requires changes in manufacturing processes, product labeling, etc. None of this happens quickly, cheaply or easily.

In the case of dyes, the data in Exhibit 4 suggests consumers may be accepting of the color change of their foods, despite a long-held belief that consumers “eat with their eyes.” But will they be as accepting of other changes recommended by MAHA? For example, seed oils that are widely in use but targeted by MAHA have an impact on the taste and texture of the food, as well as ingredient costs. Will consumers be as accepting of those changes?

And to what extent will the food industry (e.g., manufacturers, operators, etc.) push back on dietary recommendations that may not be scientifically proven but might come at the expense of affordability or consumer acceptance? Already we see the School Nutrition Association pushing back against the MAHA report’s claim that links ultra-processed foods in school meals to childhood diseases.

The likely outcome of the MAHA report and its potential influence on policy is not yet understood, but the report is likely to add additional uncertainty for foodservice operators and manufacturers already struggling with the uncertainty of inflation, consumer traffic and labor issues.

Exhibit 5

Impact of GLP-1 Weight Loss Drugs

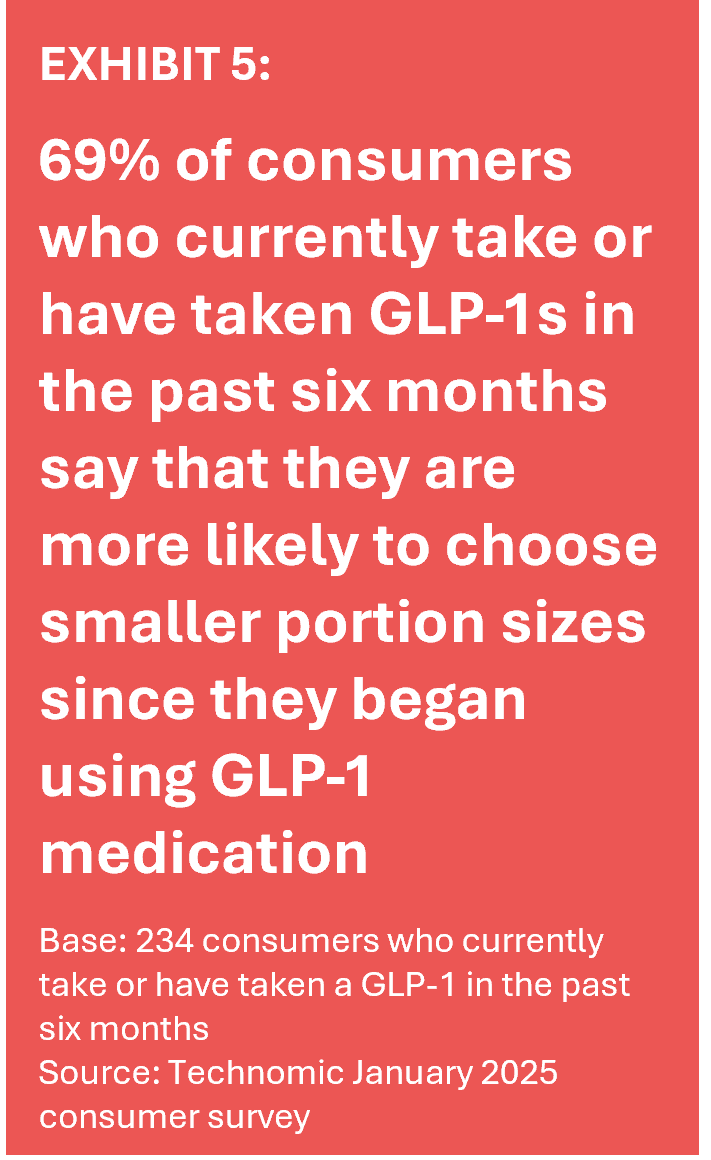

Any discussion of healthy eating must now touch on the use of weight loss drugs. A recent Technomic survey shows that 11% of consumers are currently taking a GLP-1* as consumers continue to seek ways to manage chronic health conditions or weight loss. It’s growing use has led many to wonder what the longer-term impacts of these drugs will be on the industry. It’s worth noting that our research shows GLP-1 users are most likely to say they choose healthy food and beverage away from home only sometimes (37%), rather than most of the time (28%).* That’s similar to the results for non-GLP-1 users (41% sometimes versus 25% most of the time).* This suggests even those on weight loss drugs want to indulge away from home. They are, however, more likely to feel sated morequickly, so a variety of portion sizes may be valued (See Exhibit 5).

There’s still much that remains up in the air; regulatory approvals, insurance coverage and pricing dynamics will continue to shape the future of GLP-1s and their impact on the industry longer term.

What’s Next?

The importance of healthy options is expected to continue, but we must not forget to feed the cravings that drive consumers to use foodservice and provide the taste and quality that define consumer value. This will require a balanced approach, emphasizing quality for price paid and whole/real ingredients that taste great.

There is a need to monitor and adjust to larger industry and societal shifts (e.g., state and national legislation around ingredients, GLP-1 medications, etc.) that may impact healthy eating away from home.

Health-forward trends predicted to find momentum include stealth health, functional ingredients with physical, mental and emotion benefits, and great grains and super seeds.

Recommended Actions

Interested in learning more on this topic?

Ask your Technomic representative about our recent 2025 Health in Foodservice Multi Client Study, which contains original insights from foodservice operators and consumers, available for purchase now.

NEVER MISS AN UPDATE

Subscribe to Our Emails

Unique content, conversation and thought leadership from Technomic is just a click away.